5starsstocks.com military

Introduction to 5starsstocks.com Military

The defense sector is one of the strongest parts of the U.S. economy. It supports national security, creates jobs, and drives innovation. Many investors look at military and defense stocks because they offer stability and long-term growth. That is where 5starsstocks.com military insights become helpful. This platform focuses on military-related companies, defense contracts, and aerospace growth trends.

In the United States, military spending remains high. The government invests billions every year in advanced weapons, cybersecurity, aircraft, and space programs. These investments help companies grow and deliver strong returns to shareholders. When you explore 5starsstocks.com military, you gain a clearer view of companies tied to defense, security, and innovation.

This guide explains everything in simple terms. You will learn how military stocks work, which sectors matter most, and how to evaluate risks. Let’s explore the world of U.S. defense investing step by step.

Understanding the U.S. Military Investment Landscape

The United States has one of the largest defense budgets in the world. Each year, Congress approves funding for weapons systems, aircraft, ships, cybersecurity tools, and research projects. This spending supports major defense contractors and smaller suppliers across many states.

Investors follow defense budgets closely. When funding increases, many military stocks rise. That is why platforms like 5starsstocks.com military focus on tracking contracts and government decisions. These factors shape revenue growth for defense companies.

Military investment is not only about weapons. It also includes satellite systems, drones, artificial intelligence, and secure communication networks. These areas grow quickly due to global tensions and modern warfare needs. For investors, understanding this landscape helps in making smarter decisions.

The key is to look at long-term trends rather than short-term news. Defense contracts often last for years, giving companies stable income and predictable cash flow.

Why Investors Are Watching Military Stocks

Military stocks attract attention for many reasons. First, they often perform well during uncertain times. When global tensions rise, defense spending usually increases. This makes defense companies more stable than many other sectors.

Second, many defense firms pay dividends. Investors enjoy steady income along with potential growth. Third, these companies often have strong government backing, which reduces business risk compared to private industries.

Through 5starsstocks.com military, investors can track performance trends and understand which companies benefit most from federal contracts. The site highlights companies involved in aerospace, cybersecurity, and advanced defense systems.

From my experience, defense investing works best for patient investors. It is not about fast profits. It is about steady returns over time. That is why many retirement portfolios include military and defense stocks.

Key Sectors Covered Under 5starsstocks.com Military

The defense sector is broad and diverse. 5starsstocks.com military typically covers several key segments that drive growth in this space.

One major segment is aerospace. This includes fighter jets, helicopters, satellites, and space exploration systems. Another important area is cybersecurity. As cyber threats increase, military agencies invest heavily in digital protection.

Naval defense is also crucial. Shipbuilders and submarine manufacturers receive large contracts from the U.S. Navy. Ground systems, including armored vehicles and missile defense systems, also play a big role.

These sectors work together to support national security. Investors should understand how each one contributes to revenue growth. Diversification within the military industry helps reduce risk and improve long-term stability.

Top U.S. Defense Companies to Watch

Several major companies dominate the U.S. defense industry. These firms hold long-term government contracts and lead innovation. Some well-known names include:

- Lockheed Martin

- Raytheon Technologies

- Northrop Grumman

- Boeing

- General Dynamics

These companies design fighter jets, missile systems, satellites, and advanced radar technologies. Many also invest in artificial intelligence and space defense programs.

When analyzing 5starsstocks.com military, you will often see these names mentioned because they shape the entire defense market. They operate across multiple states and employ thousands of workers. Their size and experience make them leaders in national security contracts.

How Government Contracts Impact Military Stocks

Government contracts are the lifeline of defense companies. Without federal funding, most military firms would struggle. These contracts can last many years and involve billions of dollars.

When a company wins a large contract, its stock price often rises. Investors see it as a sign of stable revenue ahead. 5starsstocks.com military often tracks such contract announcements to help investors stay informed.

Contracts are usually awarded after strict evaluation. Companies must prove technical expertise, reliability, and cost efficiency. This creates high entry barriers, which protect established firms from new competition.

However, investors should also monitor budget cuts. If Congress reduces defense spending, stock prices may fall. That is why staying informed about policy changes is essential for smart investing.

Growth Trends in Aerospace and Defense

Aerospace and defense continue to evolve. Modern warfare depends on drones, satellites, and advanced sensors. Artificial intelligence plays a growing role in military strategy.

Space defense is expanding rapidly. The U.S. government now treats space as a critical defense zone. This shift creates new opportunities for companies involved in satellite technology and space exploration.

Cybersecurity spending also grows each year. Military networks must stay secure from hacking and digital threats. This makes cybersecurity firms valuable parts of the defense ecosystem.

Through 5starsstocks.com military, investors can explore these growth trends and identify companies that lead innovation. Long-term growth depends on technological advancement and global security needs.

Detailed Table of Major Defense Companies by State

Below is a simplified table showing key defense companies and their major operational states:

| Company | Primary Headquarters State | Major Operations States | Key Focus Area |

| Lockheed Martin | Maryland | Texas, California, Florida | Fighter Jets & Missiles |

| Raytheon Technologies | Virginia | Arizona, Massachusetts | Missile Systems & Radar |

| Northrop Grumman | Virginia | California, Utah | Space & Defense Tech |

| Boeing | Virginia | Washington, Missouri | Aircraft & Space Systems |

| General Dynamics | Virginia | Connecticut, Texas | Naval Systems & Combat Vehicles |

This table helps investors understand geographic influence. Defense companies often operate in multiple states, boosting local economies.

Risks Associated With Military Investing

No investment is risk-free. Military stocks also carry certain risks. Budget changes, political shifts, and global peace agreements can affect defense spending.

If tensions decrease worldwide, governments may reduce military budgets. This could slow revenue growth for defense companies. In addition, cost overruns on projects may reduce profit margins.

Investors using 5starsstocks.com military insights should balance risk and reward. Diversifying across multiple defense sectors helps reduce exposure.

Another risk is regulatory oversight. Defense companies must follow strict rules. Any violation can lead to fines or contract loss. Smart investors study financial reports and government policies before investing.

Benefits of Long-Term Defense Investments

Despite risks, defense investing offers many benefits. These companies often have stable income from government contracts. They also invest heavily in research and development.

Long-term investors may benefit from steady dividends and gradual price appreciation. Defense stocks often recover quickly after market downturns due to their stable demand.

From my observation, patient investors who focus on fundamentals tend to see consistent growth. Military contracts provide long-term security compared to short-term consumer trends.

By reviewing 5starsstocks.com military analysis, investors can identify companies with strong balance sheets and reliable earnings history.

How to Evaluate Military Stocks Smartly

Start by checking revenue sources. A company heavily dependent on one contract may carry higher risk. Diversified contracts across departments are safer.

Next, review profit margins and debt levels. Healthy companies maintain strong cash flow. Also, study research investments. Innovation drives future growth in defense markets.

Look at leadership experience. Experienced executives understand government processes better.

When using 5starsstocks.com military, compare stock performance trends and contract pipelines. Make decisions based on data, not headlines.

Military ETFs vs Individual Defense Stocks

Some investors prefer defense ETFs. These funds include multiple military companies in one basket. This reduces individual stock risk.

Others prefer buying shares in specific companies like Lockheed Martin or Northrop Grumman. This approach may offer higher returns but also higher risk.

If you are new to investing, ETFs provide safer exposure. If you have experience, individual stocks may offer more control.

Platforms covering 5starsstocks.com military trends often analyze both strategies to help investors choose wisely.

FAQs About 5starsstocks.com Military

1. What is 5starsstocks.com military?

It is a resource focused on military and defense stock analysis, contracts, and investment trends.

2. Are military stocks safe investments?

They are generally stable but still carry market and political risks.

3. Why does U.S. defense spending matter?

Higher spending often boosts defense company revenues and stock prices.

4. Do military stocks pay dividends?

Many large defense firms provide regular dividends.

5. Is defense investing good for beginners?

Yes, especially through ETFs for diversified exposure.

6. How often does defense spending change?

Budgets are reviewed yearly and adjusted based on national priorities.

Conclusion: Is 5starsstocks.com Military Worth Exploring?

Military investing remains one of the most stable sectors in the U.S. market. Strong government support, innovation, and global security needs drive consistent demand.

By following 5starsstocks.com military insights, investors gain access to trends, contract updates, and company performance data. This helps in making informed decisions.

Defense stocks may not offer overnight success, but they reward patience. If you seek steady growth and reliable dividends, this sector deserves attention.

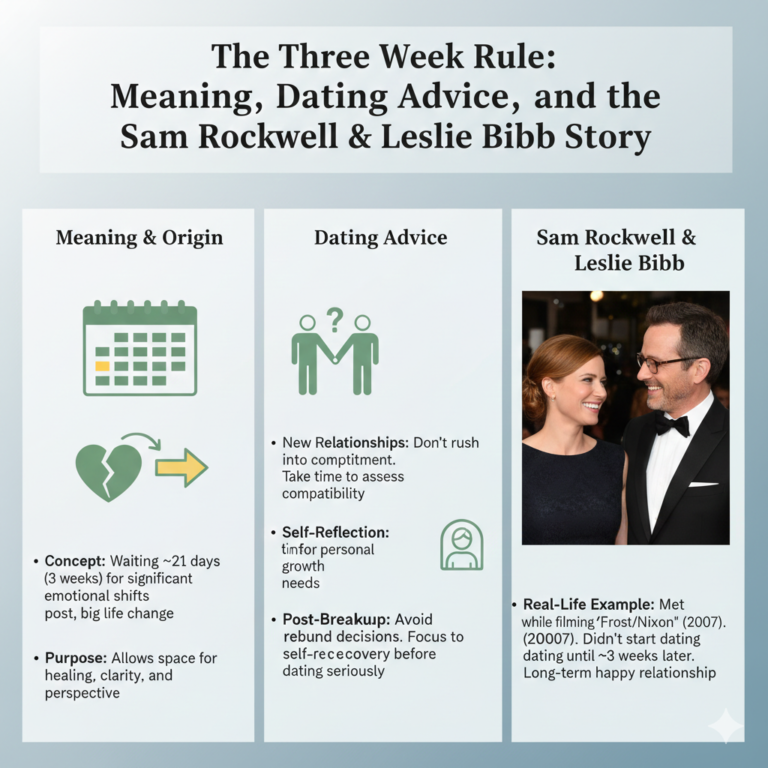

YOU ALSO LIKE TO READ: The Three Week Rule